The U.S. Auto Industry Drives Domestic Job Creation

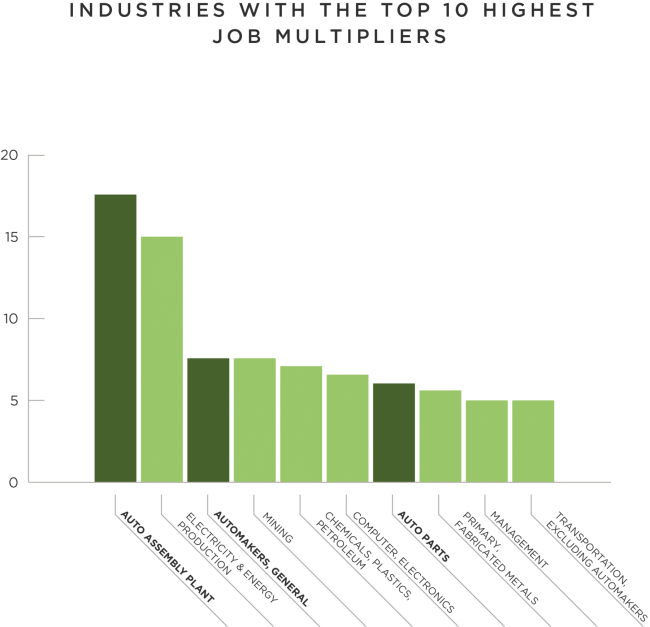

From research labs and supplier factories to assembly lines and dealership showrooms, U.S. automakers, their suppliers, their dealerships, and the local businesses that support them are responsible for more than 7.25 million U.S. jobs. No manufacturing sector employs more U.S. workers.

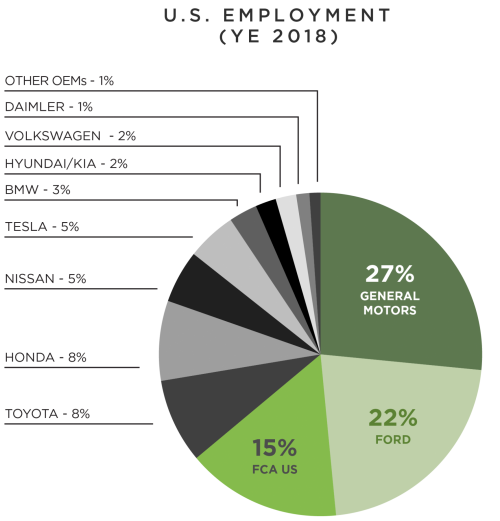

Together, the 15 major automakers competing in the U.S. directly employ about 388,000 U.S. workers. FCA US, Ford, and General Motors employ 238,000 of these U.S. workers, meaning that FCA US, Ford, and General Motors employ nearly 2 out of 3 of America’s autoworkers.

The fact that FCA US, Ford, and General Motors account for 64% of U.S. auto jobs is remarkable, especially considering that they account for only 44% of U.S. market share.

FCA US, Ford, and General Motors produce more of their vehicles here, conduct more of their research here, and buy more of their parts here. As a result, they have based nearly seven times more of their global workforce in the U.S. than their competitors.

US Employment (YE 2018)

FCA US/Ford/ General Motors employ 2 out of 3 of America’s autoworkers, translating to 238,000 jobs.

Industries with Top 10 Highest Job Multipliers (2018)

-

Ford Motor Company Joins Forces With Tom Joyner Foundation To Honor Unsung Heroes

Ford Motor Company is taking its Ford Freedom Unsung program to a national level by collaborating for the first time with Tom Joyner Foundation.

-

GM Launches Career Re-Entry Internship Program

General Motors today announced an innovative pilot internship program aimed at experienced women engineers who are interested in returning to the workforce a

-

GM Takes Top Honor in IHS Automotive Loyalty Awards

DETROIT – General Motors was recognized by IHS Automotive today, with its Overall Loyalty to Manufacturer award. -

GM Fort Wayne Assembly Builds 7 Millionth Truck

ROANOKE, Ind. – General Motors’ Fort Wayne Assembly Plant built its 7 millionth pickup truck today with the customer purchasing the blue double-c

-

Chevrolet Gears Up To Support Wreaths Across America Initiative

As the holiday season sets in, many families often are pained with the loss of a loved one, especially from the armed forces.